The first thing a financially prudent person wants to do when they have some spare money is to let the money work for them. But if you don’t make the right decision you could end up losing the money instead of making profits.

Neil Timmins has an offer for people who are looking for a safe investment. He says his real estate investment is the best decision you can make. He also says you can do this without worrying about the daily management of your investment.

Now, before you read what I have to say about Neil’s program, let me let you in on a little secret: there are 2 categories of real estate: physical and digital. Imagine if you could rent out DIGITAL properties. I’m talking about renting out properties that exist ONLINE only (not in the physical world). You may not know this, but properties like this can get you much higher rent, and there are no property taxes, no repair costs, no homeowners insurance, and the profits can be MUCH greater: Digital Real Estate Video Here.

Here’s a video of my daughter’s business using this :

Click Here to Get The Course My Daughter Used.

The course my daughter used above is much better than Neil Timmin’s program. But since you are here to learn about Neil Timmins, lets get back to that:

What is Legacy Impact Investors?

Legacy Impact Investors is Neil’s real estate investment company that focuses on commercial property investments in the Midwest. The company claims to invest your capital and help you to earn passive income.

Who is Neil Timmins?

Neil had an established career in banking before entering into the real estate industry. By age 29, he received recognition by Wall Street as a Top 100 team. When he entered the real estate industry, he managed to Fix, Flip, and wholesale several properties but he hated the way things worked.

He had to exchange his time for money and he grew tired of it quickly. He decided to re-strategize so that he could make passive income from his single-family portfolio and he did. But things changed quickly when he accidentally came across a commercial deal which became his first commercial deal.

He changed his strategy to accommodate the purchase of commercial properties to help him make a more reliable income. Neil’s commercial assets include office spaces, apartments, mobile home parks, apartments, and self-storage units. He has been involved in real estate transactions worth $300,000,000.

Neil is the author of the book; Unicorn Hunting – For Real Estate Investment Companies. He spends a lot of his time talking about real estate. Neil also loves spending time on water and traveling. He is married with 3 children.

How Does Legacy Impact Investors Work?

To invest, you need to first complete a form on the company’s website. You will be required to choose the kind of investment you want. There is the Accredited Investor; that’s someone ready to provide the investment capital without being involved in the investment process. Then there is the Sophisticated Investor; this option is for people who have enough knowledge in real estate investment and want to be in charge of their own investment.

Once you complete the form, you can go ahead and schedule a call with a member of the team. The company has revealed their process, including how they acquire properties, and how their clients can make money from their investments.

The company acquires properties in two ways. They either get them from their network of brokers or the sellers directly. They do not deal with every property that comes their way.

The company focuses on purchasing industrial properties that have stable tenants in long-term lease agreements. The tenants should have good credit and their lease should be a minimum of five years. The properties are worth between $2 million to $8 million.

According to Neil, people who invest will enjoy several benefits. These investors will benefit from both regular and passive income. He also revealed that investors are protected against inflation through value appreciation and income generation.

You also don’t need the huge capital required to buy a typical real estate property if you invest with Legacy Impact. You won’t need to worry about all your investments being in one type of investment since real estate investment is a different type of investment compared to stocks and bonds. You will have a diversified portfolio when you invest with Neil even if you have other kinds of investments.

You will enjoy great returns since real estate appreciates in two ways; forced appreciation and market appreciation. You also get to enjoy lots of tax breaks and deductions that can add up quickly.

Neil and his team will also give you timely reports on your investments and you can reach team members within hours if you have questions.

What is the Cost of Neil’s Investment?

Neil does not mention a specific amount required for the investment. But they have criteria for Accredited Investors. Potential investors need to have a minimum income of $200,000 in the past two years and be expecting to earn same in the current year.

Or they need to earn a combined minimum income of $300,000 with their spouse in the past two years and expect to make the same in the current year. If these do not apply, then they need to have an individual net worth of $1,000,000 or more. You will need to specify this in the form before you can schedule a call.

Refund Policy

The company has not mentioned any refund policy on its website.

Should You Invest in Legacy Impact Investment?

We think Neil tries to be quite transparent with his process and that’s great. We also think he has considerable experience in making passive income but we are not certain about how he handles real estate processes. We looked at a couple of reviews to help know what people who have had an experience with Neil think of his business processes.

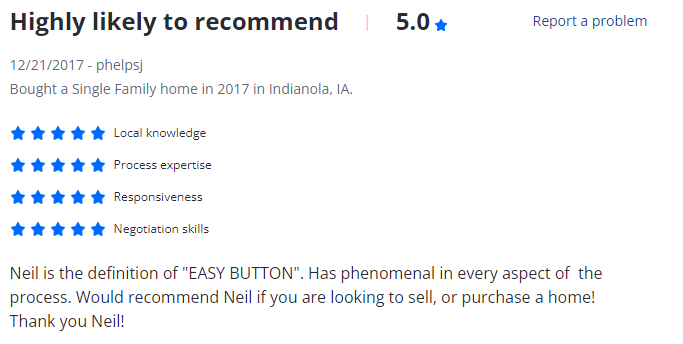

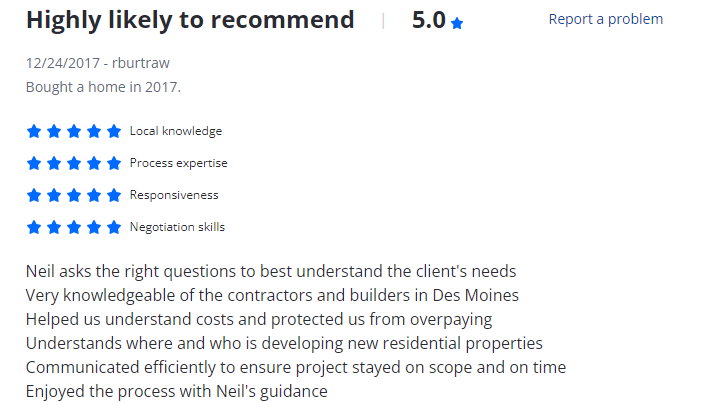

The reviews on Zillow are positive. One reviewer commended Neil for the kind of questions he asked when he worked with him. He revealed that Neil is very knowledgeable in the real estate industry and ensures that his clients are protected. Another reviewer said working with Neil makes everything easier.

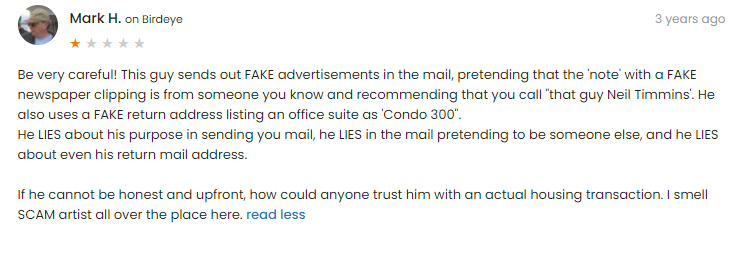

We found a negative review on Birdeye and this reviewer accused Neil of sending out fake advertisements and using a fake return address.

Since the positive reviews outweigh the negative, we will take that as a good sign. Especially since the person who wrote the negative review hasn’t worked with Neil.

Our recommendation is, that if you are interested in real estate investment and Neil’s offer sounds good, go ahead and complete the form. Schedule a call with the team and listen to what they have to say. If it sounds good, go ahead and invest in it.