When you think about investing in real estate, buying and selling properties at a profit is the first thing that comes to mind. While it is the most common real-estate model, other real-estate models still need exploring.

Jay Drexel introduces you to a rare yet rewarding real-estate investing model called tax lien investing. He provides a training program to teach you how to do it and provides software you can use to get started. If this is something you’d like to try, read on to find out more about the United Tax Liens program.

But… before you read what I have to say about Jay’s course, imagine if you could rent out DIGITAL properties. I’m talking about renting out properties that exist ONLINE only (not in the physical world). You may not know this, but properties like this can get you much higher rent, and there are, no property taxes, no repair costs, no homeowners insurance, and the profits can be MUCH greater: Digital Real Estate Video Here.

Here’s a video of my daughter’s business using this :

Click Here to Get The Course My Daughter Used.

The course my daughter used above is much better than the United Tax Liens program. But since you are here to learn about the program, lets get back to our review of that:

Who is Jay Drexel? The Brains Behind United Tax Liens

Jay Drexel is the founder of United Tax Liens. He has vast experience in the industry, having invested in tax lien and deed investments for more than 10 years. Jay is a respected expert in the real estate industry and has been featured in many publications, including The Wall Street Journal and Forbes.

His story is about rags to riches as he ventured into this trade after going dead broke many moons ago. With just over $150 in his bank account and a foreclosed home, Jay was forced to go back to his mother’s home.

It was then that the idea of tax lien investing came to mind. He has never looked back after making his first investment with only $100. Many investments later, Jay Drexel lives his best life. He later decided to train other people to do tax lien investing using his program United Tax Lien.

What is United Tax Lien?

United Tax Lien is a training program that teaches you how to buy and sell tax liens online at a profit. The program can be divided into three parts:

The Course

United Tax Lien offers training to help you start tax lien investing. You learn which states issue tax liens, tax deeds, and mistakes you must avoid when making such investments. The course also provides a list of 1000 tax default properties you can look up to kickstart your investment journey.

Marketplace Pro Software

That’s not all; Jay offers software called Marketplace Pro Software that shows you an easy way to start investing. It makes tax lien investing easy by helping you identify profitable investments quickly. Once you identify a property you’re interested in, the software provides all the information about that property.

Coaching and Consulting

Tax lien investing is a relatively new real-estate investment model for many people hence the need for expert advice. Jay knows this all too well and offers expert guidance with other experienced investors. Their expertise helps beginners learn how to invest and make profits faster.

What is Tax Lien Investing?

Tax lien investing is probably alien to some people, so we’ll provide a brief overview. Tax lien investing is an investment model that allows an investor to add a property to their portfolio without owning it.

The investor purchases tax-lien certificates through an auction giving them the right to collect your investment by:

- Collecting property taxes and interest owed from the homeowner

- Beginning the foreclosure process if the homeowner fails to pay the property taxes

Tax liens provide legal claims on a property with unpaid property taxes. The city or county places tax liens on such properties, and they act as legal claims for the amount owed. Properties with tax liens can’t be refinanced or sold until the homeowner pays taxes and the lien is removed.

Once the city or county council places a lien on a property, it issues a tax lien certificate showing the unpaid tax, interests, or penalties owed. The government can sell tax lien certificates to private investors to recover the amount owed faster. And that’s where Jay’s United Tax Lien training program comes in handy. It shows you the nitty-gritty of investing in tax lien certificates.

What is the Cost of the United Tax Lien Program?

You pay a one-time fee of $97 for the program and an additional $27 to access live tax lien auctions. It’s a great way to see how experts find state auction websites, bid on properties, and close deals.

The program also comes with a 30-day money-back guarantee that allows investors to get a refund if they’re unhappy with the program.k

United Tax Lien Customer Reviews: What are Others Saying about the Program?

It’s important to find more information about a training program before spending money. Here’s what I found about the United Tax Lien program.

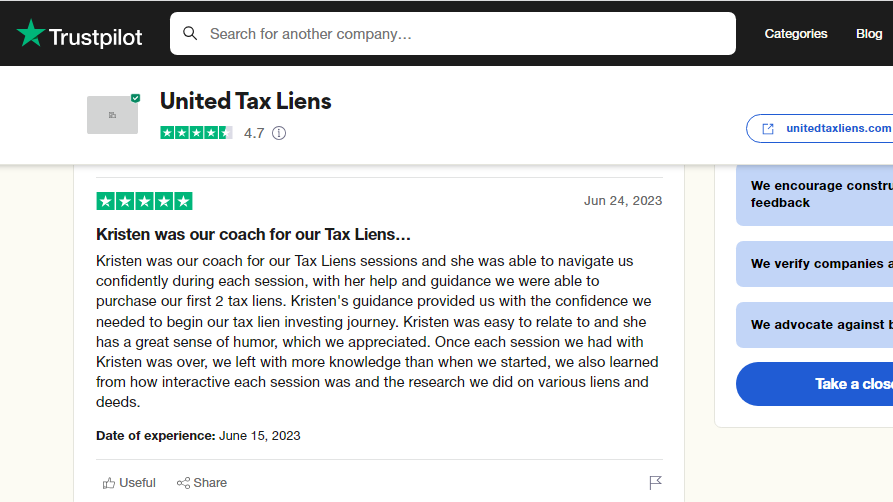

Bought out first 2 tax liens:

This customer obtained lots of insight from the coaching sessions. In fact, they managed to buy their first two tax liens at the end of the sessions.

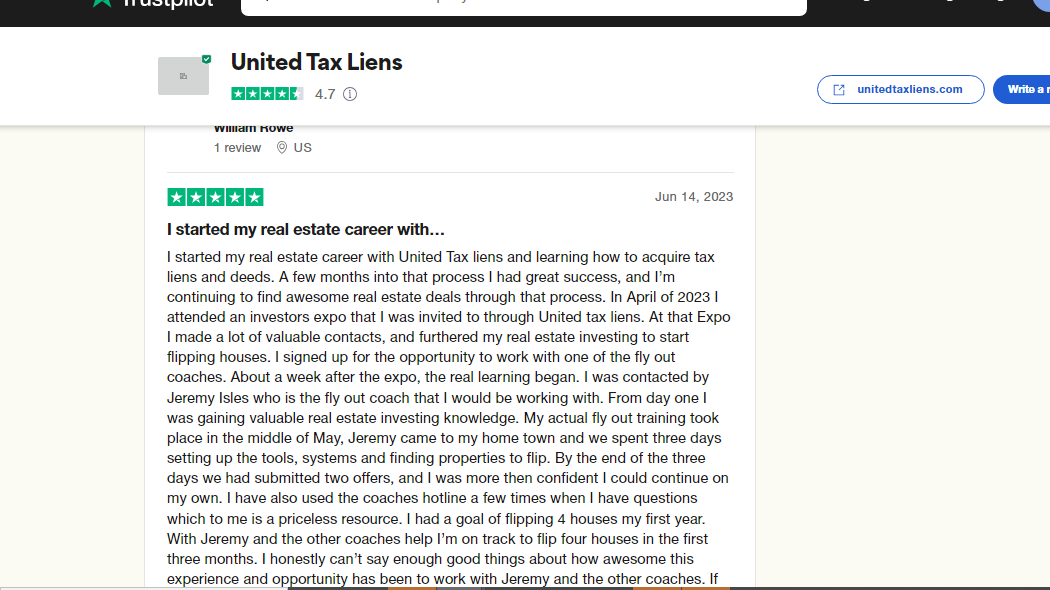

Flipped 4 Houses in 3 Months:

This customer says the program boosted his confidence in his real-estate investment. After attending an investors expo courtesy of the United Tax Liens training program, he interacted with potential clients and began flipping houses. With the coach’s help, he submitted two offers in just two weeks and his goal is to flip 4 houses in three months.

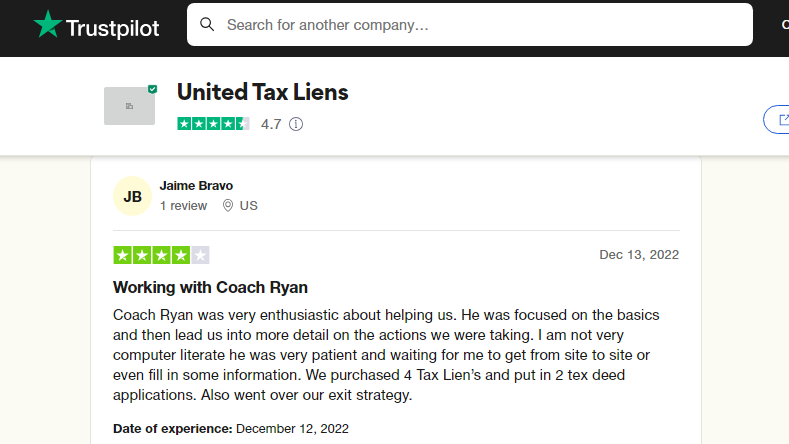

Bought 4 Tax Liens:

The customer has managed to buy up to four tax liens and applied for two tax deeds using the program and the coach’s help.

Should Subscribe to the United Tax Lien Program? My Verdict

Tax lien investing is certainly a complicated real-estate investment model. Thus finding a program that can help you venture into it is quite welcoming. The United Tax Lien program goes above and beyond. Not only do you get insightful information about tax lien investing, but you also get software to help you go about it. Although I’d have loved to see more reviews about the program on other third-party sites like Reddit and Better Business Bureau, the coaches hold your hand throughout the process, which boosts your confidence. I recommend investing in the program. It’s affordable and equips you with expert information on tax lien investing.

Related posts:

- Freedom Mentor Apprentice Program [ Real estate investing ]

- The Multifamily Mindset Review [ Property investment mentoring ]