Reviewing real estate programs is my thing. Whenever I see lots of people asking about how good or bad a program is, I jump in to find the answer. Here I am with another review of a popular real estate program.

This time, I will be reviewing the Open Spaces Portfolio Program. This article will give you more information about the program and answer the right question so that you can easily make an informed decision. Read on to find out more about this program.

But… before you read what I have to say about Open Spaces Portfolio, imagine if you could rent out DIGITAL properties. I’m talking about renting out properties that exist ONLINE only (not in the physical world). You may not know this, but properties like this can get you much higher rent, and there are no property taxes, no repair costs, no homeowners insurance, and the profits can be MUCH greater: Digital Real Estate Video Here.

Here’s a video of my daughter’s business using this :

Click Here to Get The Course My Daughter Used.

The course my daughter used above is much better than the Open Spaces Portfolio program. But since you are here to learn about Open Spaces, lets get back to our review of that:

What is Open Spaces Portfolio Program?

This is a program created by the owners of Open Spaces Capital to help people build generational wealth by investing in real estate. The program teaches a supercharged strategy to quicken the pace for scaling your rental portfolio.

The idea is to help people earn enough money so that they can have more time for personal development, and also engage in hobbies.

Who are the Creators of the Open Spaces Portfolio Program?

The program was created by Palak Shah and Niti Jamdar. Palak is a trained Mechanical Engineer who took a plunge into real estate and never looked back. Palak worked as a mechanical engineer in four different companies for 13 years before founding Open Spaces Capital in 2015.

Her desire to start Open Spaces was due to the inflexibility of her Mechanical Engineer career. She wanted to be present for her family and that was when she invested in real estate. She turned her $25,000 investment into a $5 million portfolio in less than 4 years.

Her work at Open Spaces Capital involved renovating old buildings and this allowed her to bring her skills including Project Management, Engineering, and Business Development to her work. Since the company was already involved in Real Estate, she founded the Portfolio Programme based on her tried, and tested BRRRR blueprint.

Her partner, Niti has 20 years of experience in strategic leadership and has worked as an executive for a Fortune 100 company. Niti joined as the co-founder and managing partner of the company in 2020. He is a finance, strategy, and audit expert who is using his expertise to scale the company quickly. He is the brain behind most of the financial innovations in the company. He hosts a lot of real estate programs with Palak. Palak and Niti are not only business partners; they are also life partners.

How Does the Open Spaces Portfolio Program Work?

The program centers on the Buy, Rehab, Rent, Refinance, Repeat (BRRRR) strategy. Thus, you purchase a rental property, renovate it, and then rent it out at a higher price. Then you refinance it through the bank to recover your initial investment.

The money you get is channeled into purchasing another property and the cycle continues. The program will teach you how to go about each step of the process and they also teach you how to get funds for these projects.

When you join the program, you get access to a private Facebook group, bi-weekly calls, and enlightening sessions with other real estate investors. Networking is not only online, there are arrangements for coffee meetings and dinner get-togethers.

You will have access to training modules that you can study at your own pace. The modules will give you the information you need to decide the area you want to choose for your business. It will also give you the knowledge to choose the specs and even contractors you want to work with. The program is a 3 months program and people are trained in cohorts.

The company also has several other real estate programs that are a bit different from the Portfolio program. They have the 5-hour #BRRRR Accelerator Program which is intended for busy professionals who want to scale their business.

There is also a free 5-day pop up challenge for high-earners who work in corporate. This real estate program is designed to help them retire early. This program targets people who have never invested in real estate and are considering it.

Palak and Niti have also published a book called Accelerate Your Real Estate Investment.

What is the Cost of the Program?

The program costs $8000 but you need to minimum seed money of $25,000. According to Palak, they believe in responsible coaching which is why they do not focus on strategies that require no down payment.

The 5-hour #BRRRR Accelerator Program costs $27.

Refund Policy

The company has a 30-day money-back guarantee for the Portfolio Program but this is subject to review.

Should You Invest In the Open Spaces Portfolio Program?

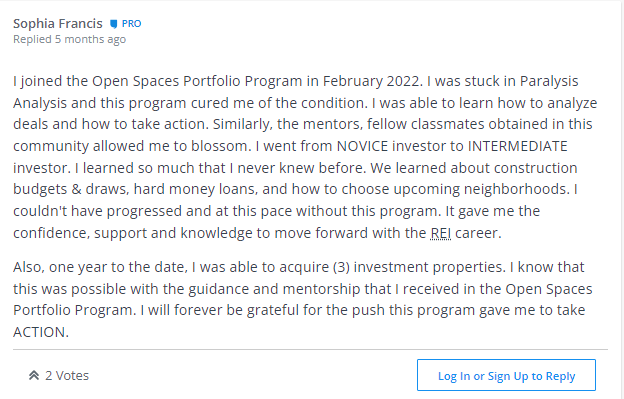

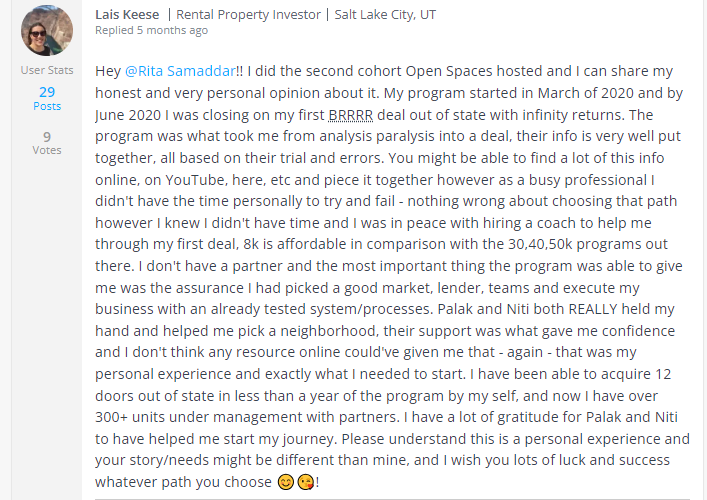

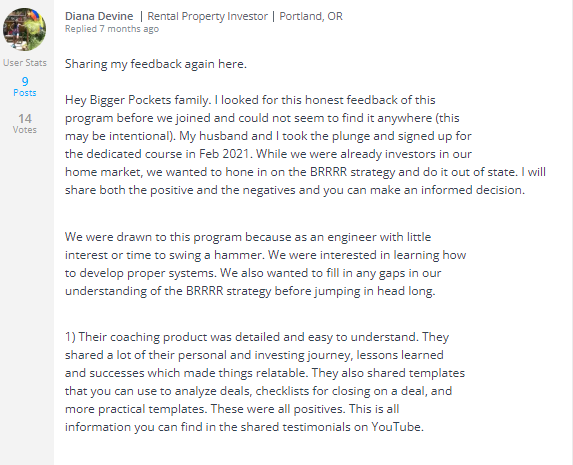

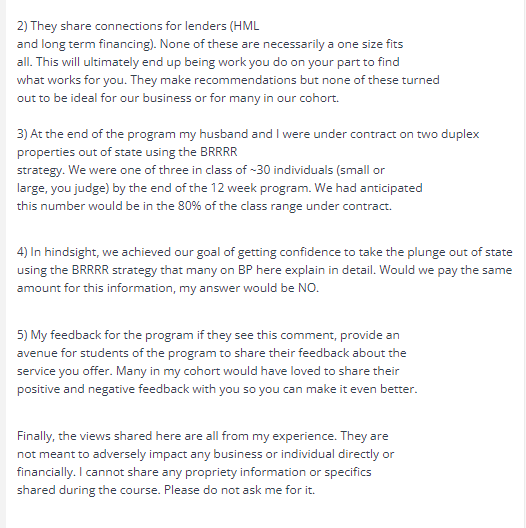

The creators seem to have a vast knowledge of real estate since they themselves have made money from it. I, however, think the program is quite expensive considering the fact that it is built on a popular strategy (BRRRR). They have a good number of reviews on biggerpockets.com which gives you a clear view of what participants think of the program.

Most of the participants were happy with their results. According to some of them, although you may find some of the information they provide online and in books, it will be difficult to pick apart the accurate information from the non-factual ones. They also mentioned that you get to save time from doing a lot of research since the information Open Spaces provides is well put together.

Some positive reviewers also talked about the opportunities they got thanks to the Open Spaces community. Most people also mentioned that they got the results they were expecting. One of the reviewers revealed that she made 10 times more than the amount she invested in the program. Lots of them recommend the program.

The negative reviews mostly talked about how expensive the program was.

This means the program worked for a lot of people and that’s a good thing. You can easily afford it, you can go ahead and purchase the program. If you cannot afford it just yet or are still skeptical about investing this much in the program, try their free program, invest in the $27 seminar, and see if you like their approach before considering this program.

Related posts:

- VestorPRO [ Property investment mentoring ]

- Surplus Fund Mastery [ unclaimed funds on foreclosed properties ]