Many sources of passive income have an multi-level marketing business model, which requires clients to sell a product or service and market it to friends and family while recruiting them to your network. If you’ve tried one, you know how exhausting the process can be. Well, it doesn’t have to be this way.

Surplus Fund Mastery uses a different approach to help you make money. Find homeowners whose homes have been foreclosed, help them recover the surplus after the sale, and get paid. David Church and Spencer Vann invented this model to help homeowners recover lost fortunes while making a decent income.

But… before you read what I have to say about Surplus Fund Mastery, imagine if you could rent out DIGITAL properties. I’m talking about renting out properties that exist ONLINE only (not in the physical world). You may not know this, but properties like this can get you much higher rent, and there are, no property taxes, no repair costs, no homeowners insurance, and the profits can be MUCH greater: Digital Real Estate Video Here.

Here’s a video of my daughter’s business using this :

Click Here to Get The Course My Daughter Used.

The course my daughter used above is much better than the Surplus Fund Mastery program. But since you are here to learn about Surplus Fund Mastery, lets get back to our review of that:

Who are David Church and Spencer Vann? The Brains Behind Surplus Fund Mastery

David and Spencer are the founders of Surplus Fund Mastery. Formerly a math teacher, David ventured into this trade after discovering $50 billion in unclaimed funds on foreclosed homes.

Conversely, Spencer was an athlete who decided to venture into real estate as an agent. Having grown up experiencing many hurdles, he realized that life isn’t smooth sailing.

The duo also found that the state has another $15 billion in unclaimed tax overcharges and $15 billion in unclaimed mortgage overages. That’s a cool $80 billion in unclaimed state funds. When a homeowner defaults on mortgage payments, e.g., due to a divorce, illness, accident, job loss, or other unfortunate circumstance, his home will likely go into foreclosure.

If the homeowner had made payment for some time, the home would have increased in value.

This means the home’s value is more than the amount owed to the bank. If the property is foreclosed and sold through an auction sale, the investor will likely purchase it at a discounted price.

According to Federal law on foreclosure, any surplus or additional funds available from the sale of a house after the creditors or lien holders are paid should be sent to the homeowner. Sadly, many homeowners are oblivious and never claim their monies.

The county’s attorney holds the money and hardly makes any effort to notify the homeowner about this surplus. David developed a system to help homeowners claim these funds and make money while at it.

So far, David and Spencer have helped recover over $10 million of unclaimed funds boosting his company’s revenue to $3.8 million. He owns a mobile home park, co-owns a 99-door hotel investment in El Paso, Texas, and is acquiring a resort a mile from the beach. He’s also the Orange County Real Estate Club President in Southern California.

In addition to training people through the Surplus Fund Mastery program, Spencer mentors aspiring business people.

What is Surplus Fund Mastery?

Surplus Fund Mastery is a program that trains you how to help homeowners get unclaimed funds on foreclosed properties. The six-week program details David and Spencer’s three steps to get his six-figure checks.

It comes with easy-to-follow video modules, contracts of people who have successfully claimed funds, scripts, coaching, and ongoing student support. In a nutshell, the program helps you:

Step 1: Find leads

The first step is identifying people with unclaimed funds from government institutions, county offices, and courts. Typically, you can find mortgage funds with the bank, court, or other trustee. On the other hand, tax overcharges are available at the local or county courts.

Step 2: Convert them to clients

Next, approach the people on the list and explain how you can help them claim their money at a fee. The fee varies based on the amount of unclaimed funds, your negotiation skills, and your geographic location. Once the client agrees to the arrangement, you can proceed to the next step of reclaiming the funds from respective institutions.

Step 3: Get Paid

If you reclaim the funds successfully, the individual pays the agreed fee, usually 10-50% of the reclaimed funds. Some states pay the finder’s fee directly, while others require the individual to collect it from the client.

What is the Cost of Surplus Fund Mastery?

You need to pay $3750 to join the Surplus Fund Mastery program. In addition to the videos, scripts, and other study material, you will receive a 30-day trial of the program’s skip-tracing software.

What are Other People Saying about Surplus Fund Mastery? Customer Reviews

While the Surplus Fund Mastery program seems helpful, it’s essential to determine whether homeowners have claimed funds successfully and if agents have made money. Upon visiting the Surplus Fund Mastery website, I found many reviews of people who have used the program, found leads, and claimed funds. Here are more customer reviews:

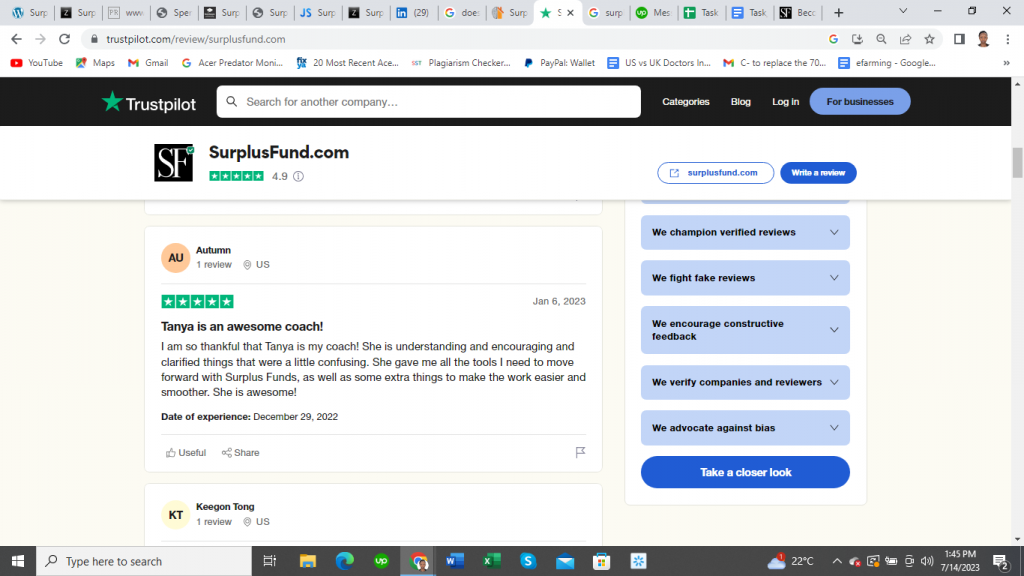

Great Support from the Coach:

The customer loved that they received tremendous support from coach Tanya who equipped them with all the tools they needed to complete the project.

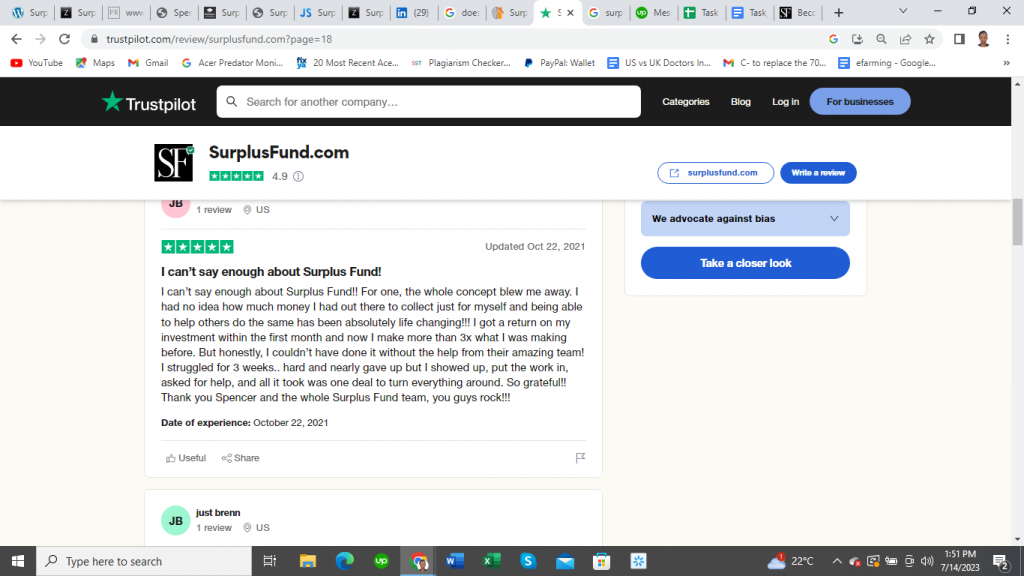

I got my Return on Investment within a Month:

Julian almost gave up, but after getting help from David and his team, he made a decent sum and is now making three times what he was making when he began.

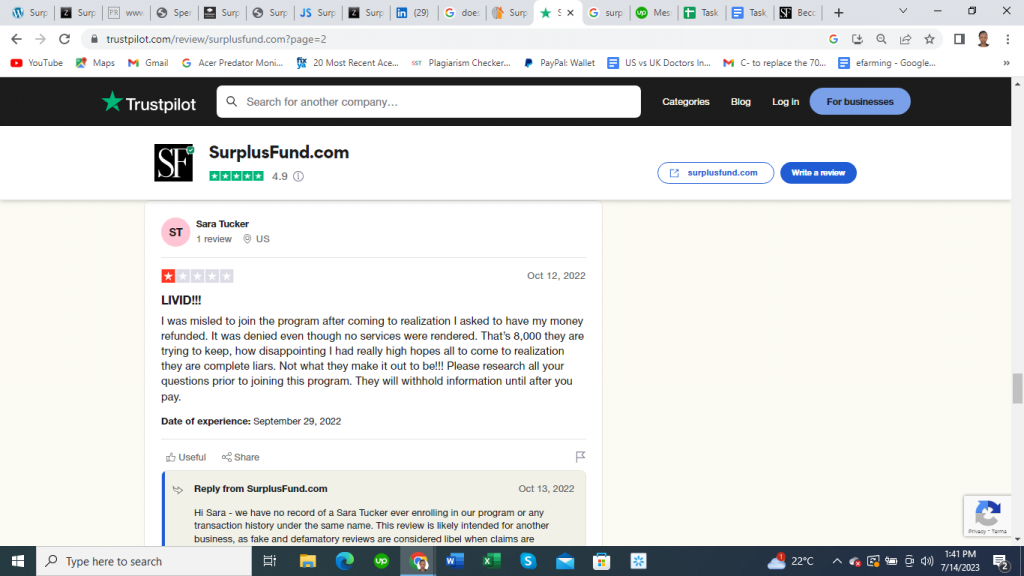

No Refund:

This customer explained that she joined the program and claimed a refund soon after. Unfortunately, the company couldn’t refund her money.

Should You Subscribe to Surplus Fund Mastery? My Verdict

Surplus Fund Mastery is quite helpful to two kinds of people- those who want to learn how to earn passive income and homeowners needing unclaimed funds. The three-step process is easy to follow, and the coaches provide excellent support to help you find leads and close deals. However, I found the program’s cost quite steep for the services rendered. Although the program has skip tracing software to help you find prospective clients, you must do a lot of legwork. Also, the fact that the program doesn’t have a refund policy means you must be extra cautious when signing up. I would have loved to see more reviews on other third-party sites. Most reviews praise the coaches and mentors but hardly clarify if they closed any deals and got paid after using the program. Best of luck on your search for a better program!

Related posts:

- Foreclosure Secrets – Our Review Of The Program

- VestorPRO [ Property investment mentoring ]