Real estate investment has been a lucrative type of investment for a very long time. And it doesn’t feel like that is going to end anytime soon. But it is only lucrative if you know what you doing. Being an old yet relevant way of making money, we are not surprised that many people are out there trying to teach people how to get into this industry.

The good thing about this is that you can find any information you want about the industry however there is no way to know if that information is accurate. Thus, you could end up operating on wrong information and making expensive mistakes. This is why finding a one-in-all source that will provide accurate information is great.

Well, even finding these training sources still raises a lot of questions. One of the most prominent questions is, will they provide everything they promise to provide? Finding answers to this question can be tough and this is why we are here to help you find answers. Today, our emphasis is on a popular real estate training program offered by The Creative Investor.

But… before you read what I have to say about the Creative Investor, imagine if you could rent out DIGITAL properties. I’m talking about renting out properties that exist ONLINE only (not in the physical world). You may not know this, but properties like this can get you much higher rent, and there are no property taxes, no repair costs, no homeowners insurance, and the profits can be MUCH greater: Digital Real Estate Video Here.

Here’s a video of my daughter’s business using this :

Click Here to Get The Course My Daughter Used.

The course my daughter used above is much better than the Creative Investor program. But since you are here to learn about the Creative Investor, lets get back to our review of that:

What is the Creative Investor?

The creative investor trains investors to attain success in the real estate industry through their main program called the Rent to Own Cash Cash Flow Program. This program teaches you how to find, work, and close deals with ease.

Who is the Creator of the Creative Investor?

The company was founded by Cam Rowland. A real estate investor who has over a decade of experience in using leasing strategies. He quit his job two years into real estate investing to focus on real estate and he has not looked back since.

By his fifth year, he had acquired over 50 properties without using his own money. After exploring lots of strategies and finding foolproof ways to invest in real estate and make good money, he set out to help others do the same.

He launched his real estate courses for people who want to attain success in the industry without having to go through the trial-and-error path. Cam is a husband, father, and grandfather. He currently lives in Canada.

How Does the Rent to Own Cashflow Program Work?

This is a 6-week self-study program that is meant to answer all your questions at your own pace. According to the creator, he invested in two real estate programs early on in his career and they both seemed rushed since he was expected to complete them at a specific period. He said he completed them with so many questions at the back of his mind and he wondered if the answers were mentioned but he missed them or they were not mentioned at all. This is why he decided to make the program a self-paced one so that you can pause, go back and confirm information, and go through it only when you are not distracted. There will be video and audio materials for this course.

Week 1 of the program talks about what you should expect in the program as well as two important concepts; mindset and personality profile. These two will prepare you better for success. The 2nd week will talk about marketing. This session will help you craft your elevator pitch and market to the various groups of people you will meet in the industry.

The third talks about working with tenant buyers. You will have access to the checklist Cam Rowland uses to qualify these buyers. He will also teach you how to run background checks on them and the entire process of working with the buyers. He will also give you contracts you can use to seal these deals.

Week 4 throws more light on working with investors. You will learn more about Sandwich Lease Option (SLO) and many other strategies. You will also get access to contracts that you can use for investor deals.

The fifth week takes you through everything you need to know about the Rent to Own strategy. Then the final week will teach you more about goal setting. Every week has action steps to help you turn the lessons you have learned into actionable processes.

What is the Cost of the Program?

The Rent to Own Cashflow program costs a one-time payment of $2997.00. There is another program called Co-llab which costs $49.

Refund Policy

The refund policy for the Rent to Own Cashflow has not been specified on the website but they mentioned that they do provide refunds for some of their programs. The policy will be specified in the fine print for each program.

Should You Invest in the Creative Investor?

The amount is quite steep for someone starting out but if it will truly set you on the path to success then it is worth it. The good thing is that Cam broke down the content of the program making it easier for you to decide if that is what you are looking for.

Another thing is that Cam has a decade of experience using this strategy so you can be certain that he will bring that wealth of experience into the training.

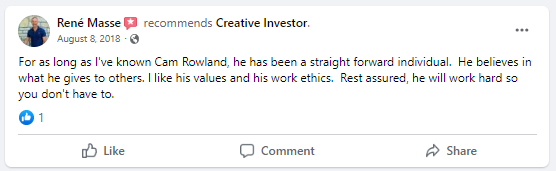

The reviews on his Facebook page are also great with one person stating how he benefitted from the information he got from Cam. He specifically mentioned a Facebook live about the Rent to Own program.

The bottom line is that the program might be great but only if it is what you are looking for. Hence, review the information we have provided, ask questions when you book a call, and make sure you have no doubts first. If you are not sure, watch a few lives on the Creative Investor Facebook page to give you more clarity and once you are certain and can afford it, you can go ahead and invest in it. You must be in a good place to complete the cost when you purchase the course so that you don’t end up wasting money on a program you won’t benefit from.